Tax Savings & Corporate Wealth Transfer Conference for Doctors Only

Exclusive Event – Fine Dining Experience

September 21, 2025 (Sunday) · Vancouver

November 2, 2025 (Sunday) · Toronto

December 7, 2025 (Sunday) · Calgary

Hear From Past Attendees

Watch highlights and real conversations from past conferences — featuring Canadian doctors just like you.

Tailored for Experienced Doctors

This exclusive event is designed for incorporated doctors who want to reduce taxes, protect assets, and strategically grow their wealth.

Hosted by GT Wealth, a team of planners with over 100 years of combined experience, we proudly serve top 1% income earners across British Columbia, Alberta, and Ontario. As a leading one-stop firm in tax savings and corporate wealth transferring, we specialize in strategies that deliver measurable, lasting results.

Tax Savings & Corporate Wealth Transfer Conference for Doctors Only

Exclusive Event – Fine Dining Experience

September 21, 2025 (Sunday) · Vancouver

November 2, 2025 (Sunday) · Toronto

December 7, 2025 (Sunday) · Calgary

Choose the Topics That Matter Most to You

To ensure every guest receives maximum value, each session is limited to just 20 doctors. Attendees can select the topics that matter most to them, and our expert speaker will provide actionable insights on the relevant sections of the Income Tax Act to help you achieve targeted wealth creation and tax savings — ranging from millions to tens of millions.

✅Income Tax Act s. 15(1)

Use corporate assets to reduce tax when repaying a personal mortgage or acquiring personal property.

✅ITA s. 20(1)(c)

Transfer corporate assets to personal hands with a 50% tax offset and reduce passive income taxed at 50% to retain capital.

✅ITA s. 148

Withdraw RRSP/RRIF tax-efficiently; implement a self-insured retirement plan to minimize 50% tax and a 15% government claw back.

✅ITA s. 138.1

Invest through Canada, U.S., Europe, and Asia sector funds with 2–3× returns (2014–2024) and optional principal guarantees.

✅Income Tax Act s. 85

Transfer shares to family without immediate tax; mitigate deemed disposition capital gains tax of 25% at the estate.

✅ITA s. 104

Use trust structures to safeguard assets against mismanagement and protect from relationship breakdown.

✅ITA s. 73(1.01)

Transfer assets to an alter ego trust to avoid 5% probate fees and reduce the risk of family disputes.

Limited-Time Offer

Be among the first 20 confirmed doctors to register and attend free of charge. Your experience includes:

Fine Dining – Enjoy a three-course meal of your choice

Exclusive – Limited to doctors, and their partners

Private Q&A – 30-minute one-on-one interview

$500 Value Advice Memo – Initial report tailored to your chosen areas

Presented By - One of the most well-known high-net-worth speakers

Tax Savings & Corporate Wealth Transfer Conference for Doctors Only

Exclusive Event – Fine Dining Experience

September 21, 2025 (Sunday) · Vancouver

November 2, 2025 (Sunday) · Toronto

December 7, 2025 (Sunday) · Calgary

Case Study No. 1: Dr. Dave XXX

Below is a preview of the tailor-made 10-page Advice Memo for Dave, outlining key issues, proposed solutions, legal structures, and second-stage opportunities. If you’d like a customized Advice Memo, book a complimentary 30-minute Zoom consultation with our relationship advisor for tailored insights.

With disciplined earnings and strong family support, Dave and his wife have built a solid financial foundation as a dentist and family physician. However, their previous planning team's approach was conventional—insufficient for accelerating wealth or protecting long-term value, given their ambition and success. After attending our conference, they were inspired to pursue advanced planning and sought top-tier guidance on tax-efficient corporate asset transfers, improved cash flow for mortgage payments, and long-term retirement security—achieving a cost savings and asset creation of $9 million.

Issue 1

➡️ Dividend & Salary Tax on $350,000 & $250,000 Income

➡️ Tax Paid: $150,000 & $100,000 per year

➡️ Loss of reinvestment opportunity at 6%

➡️ Year 10 - Lost $3 million and Year 20 - Lost $9 million

Issue 2

➡️ Deemed Disposition at estate: Under Section 70(5) of the Income Tax Act

➡️ Assumption 6% growth: Estate value $67 million. Tax $16 million

Issue 3

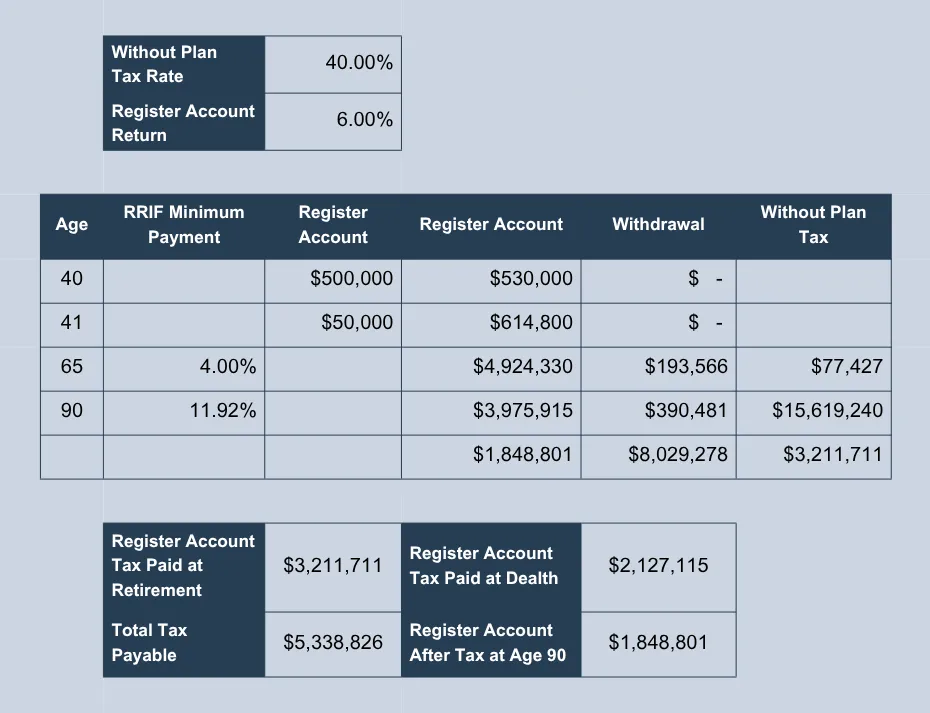

➡️ RRSP Tax Problems & Solutions

➡️ 100% taxable upon withdrawal at retirement or transfer to children.

➡️ Dave and his wife contribute $50,000 per year until age 65, then withdraw until age 90. The tax upon withdrawal is $3.2 million, and the estate tax is

$2.1 million.

Solutions

RRSP with Corporate Income Hedging and Interest Meltdown

Under Subsection 89(1) of the Income Tax Act (ITA), allow funds to grow within the company tax-efficiently and transfer them out through a Capital Dividend Account.

Under Paragraph 20(1)(c) of Income Tax Act, applying for an investment loan to create deductible interest expenses against annual income, as an alternative to making new RRSP contributions.

The above strategies can lower the tax by $2 million.

Under Section 148 of the Income Tax Act, the tax-exempt account allows for tax-deferred growth. By re-allocating $500k for 10 years into a tax-exempt account, the client could accumulate $20M by retirement.

Assign the policy to a third-party lender to secure a personal loan based on the cash value. Loan proceeds are received without triggering immediate tax, saving on $6 million taxes incurred on yearly cash flow.

Legal Document Coordination: Corporate Restructuring , Wills, Corporate Will.

✅ Corporate restructure with proper Opco and Holdco inter-company setup for $1 million tax defer transactions.

✅ Will: provides a foundational step in estate planning and ensures a seamless estate transfer, avoiding unnecessary delays and costs.

✅ Corporate Will: While Alberta has minimal probate cost, it's highly advisable to include a corporate succession plan in your Will for smooth business transition and continuity.

Additional Key Strategies to Be Reviewed After Above Priorities Are Addressed...

✅ Intergeneration Tax Saving Plan (ITSP)

✅ Alter Ego/Joint Partner Trust

✅ Estate Freeze

Tax Savings & Corporate Wealth Transfer Conference for Doctors Only

Exclusive Event – Fine Dining Experience

September 21, 2025 (Sunday) · Vancouver

November 2, 2025 (Sunday) · Toronto

December 7, 2025 (Sunday) · Calgary

🎥 Real Questions From Canadian Doctors

📸 Gallery: Our Recent Event

CLIENT TESTIMONIAL

When discerning high-net-worth clients first approached corporate tax savings and estate planning services, they often grappled with hesitation. Ultimately, why did they choose GT Wealth?

The answer lies not only in GT Wealth's innovative approach of integrating top-tier accounting, legal, and financial professionals to deliver distinctive advice but also in its dedication to clients’ goals. At GT Wealth, the standard is nothing below the best, and the priority is ensuring that high-net-worth client receives 100% at the outset and 200% throughout the decades—a commitment reflected in their glowing testimonials.

Thank you to Dr. Lawrence L. for taking the time to provide such warm and thoughtful feedback to GT Wealth, despite his busy schedule managing multiple clinics in Vancouver and Calgary.

1. What unique value have our services brought to your financial journey?

With Mr. Lau and Ace’s help, we are now set up with a tax-efficient legacy planning for our family. More importantly, they have implemented an innovative strategy that allowed us to legally support our personal mortgage payments using the corporate profits in a tax efficient way. We wish we have known of your team earlier.

2. In what ways do you feel we stand apart from other advisory teams you’ve worked with?

Prior to meeting your team, we have discussed our situation and concerns with another similar team but your team has shown us much more thorough understanding about our particular case and could offer more efficient and sensible solutions. Your role as a quarterback coordinating with our accountants and providing us creative planning ideas, have impressed us tremendously. Your company’s business model is one of a kind among your industry’s peers.

3. What inspires your confidence to recommend us to other doctors or high-net-worth families?

I believe many of our friends who have accumulated decent wealth throughout their career years with their hard work and perseverance deserve a top notch professional team to help their estate planning. We are very happy to recommend your team to our circle of friends as I believe you will also do a fantastic job for them.

Tax Savings & Corporate Wealth Transfer Conference for Doctors Only

Exclusive Event – Fine Dining Experience

September 21, 2025 (Sunday) · Vancouver

November 2, 2025 (Sunday) · Toronto

December 7, 2025 (Sunday) · Calgary

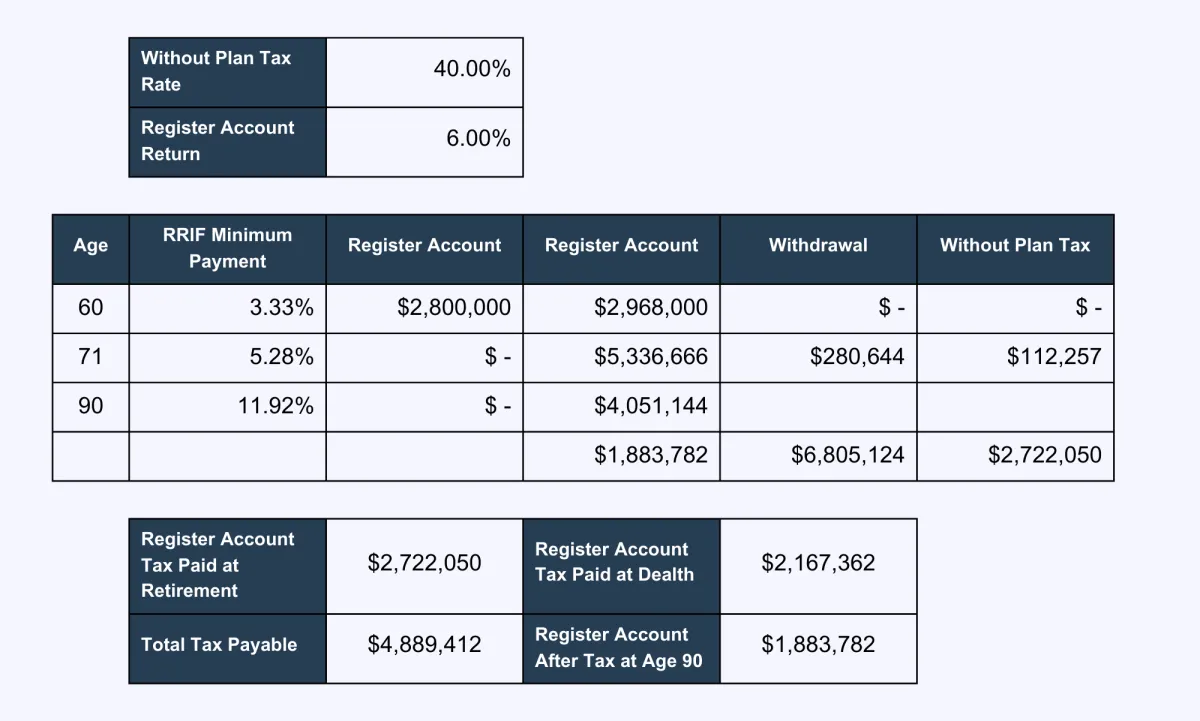

Case Study No. 2: Dr. Moha XXX

Below is a preview of the tailor-made 10-page Advice Memo for Moha, outlining key issues, proposed solutions, legal structures, and second-stage opportunities. If you’d like a customized Advice Memo, book a complimentary 30-minute Zoom consultation with our relationship advisor for tailored insights.

This accomplished doctor has built a $21.6 million portfolio across corporate holdings, real estate, and RRSPs. Their priorities are clear: unwind $2.8 million in RRSPs tax-efficiently and transition more than $12.6 million of corporate assets and investment real estate to their children with minimal tax erosion.

Despite their career success, their existing plan was sufficient for an average investor but inadequate to preserve long-term value. Through advanced structuring, Dr. Moha engaged us to reduce RRSP withdrawal taxes, facilitate efficient corporate and real estate transfers, and unlock an estimated $10 million in lifetime tax savings.

Key Financial Issues

➡️ Significant Final Tax Liabilities

Under Section 70(5) of the Income Tax Act, all capital assets are deemed disposed of at death, triggering substantial tax. Projected Estate Value (5% growth assumption): $76 million. Estimated Tax at Death: $19 million

➡️ Capital Gains on Dental Practice Sale

The dental practice is appraised at $3.5 million, with a significant capital gains tax upon sale. Estimated Capital Gains Tax: $875,000.

➡️ $2.8 million RRSP Tax Exposure

At age 71, RRSPs must convert to a RRIF, forcing taxable withdrawals on a minimum schedule. Projected Taxes During Lifetime Withdrawals: $2.72 million. Remaining RRSP at Age 90: $4.05 million — fully taxable at death, creating an additional $2.16 million tax liability. Total of $4.88 million taxes paid for the lifetime of RRSP redemption.

Solutions

✅ Estate Freeze

(Income Tax Act Section 86 & 51)

Lock in today’s asset values for tax purposes and pass future growth to the next generation tax-efficiently. You keep preferred shares equal to the current asset values, while your child receives common shares starting at zero value. All future growth accrues to the common shares.

➡️Example: $12.6M real estate portfolio projected to $42.6M in 25 years.

➡️Without planning: ~$8.9M tax.

➡️With Estate Freeze: ~$1.4M immediate exposure — a $7.5M reduction.

✅Lifetime Capital Gains Exemption (LCGE)

(Income Tax Act Section 110.6)

Shelter up to $1.25M of capital gains from tax when selling shares of a Qualified Small Business Corporation (QSBC).

➡️Qualification Criteria: Shares held >24 months by you or a related person; 50%+ of corporate assets in active Canadian business during that period; and 90%+ of assets in active Canadian business use at the time of sale.

➡️Impact: ~$312K in tax savings, with potential for an additional $500K through advanced structuring.

✅RRSP Meltdown Strategy

(Income Tax Act Paragraph 20(1)(c))

Leverage the interest meltdown strategy to gradually draw down RRSPs while reducing overall lifetime tax. By withdrawing $100,000 annually from your RRSP and using the proceeds for interest funding, these interest payments become fully deductible against your personal income.

➡️Results: $2M transferred from RRSP with ~$1.07M tax savings, while also reducing tax payable at both withdrawal and death.

Additional Key Strategies to Be Reviewed After Above Priorities Are Addressed...

✅Family Trust

Asset protection & income splitting

✅Shared-Ownership Plan

Income protection and a guaranteed retirement fund via tax free corporate funding reimbursement via this plan

✅Health Spending Account (HSA)

Tax efficient way for personal medical expenses through your corporation

✅Property Tax Savings Program

Utilize on annual property taxes immediately

Tax Savings & Corporate Wealth Transfer Conference for Doctors Only

Exclusive Event – Fine Dining Experience

September 21, 2025 (Sunday) · Vancouver

November 2, 2025 (Sunday) · Toronto

December 7, 2025 (Sunday) · Calgary

Updated in 2024

20+

New Conferences

1,000+

New Doctors & Dentists Consulted

$100 millions+

New Wealth Managed

Tax Savings & Corporate Wealth Transfer Conference for Doctors Only

Exclusive Event – Fine Dining Experience

September 21, 2025 (Sunday) · Vancouver

November 2, 2025 (Sunday) · Toronto

December 7, 2025 (Sunday) · Calgary

Book a complimentary 30-minute Zoom consultation with our relationship advisor for tailored insights.

FOLLOW US

For ticket inquiry, please contact our high net worth team: 604-910-0124

Our Offices:

405 - 6388 No. 3 Road, Richmond, BC

Metro Tower II, Suite 2660-4720 Kingsway, Burnaby, BC

N500 - 675 Cochrane Drive North Tower, Markham, ON

9140 Leslie Street, Suite 208, Richmond Hill, ON